Paychex eServices Portal

The Paychex eServices is an employee self-service portal started to provide quick access to resources available to companies who use the services of Paychex for payroll processing. This portal can be accessed from anywhere in the world where an individual with internet connectivity and proper login credentials.

Employee self-service allows your employees access to various functions on their portal, such as viewing and printing their paychecks, viewing their deduction and contribution information, viewing their tax-related information, and more. A company can choose which functions they want to make available on the portal.

About Paychex

Paychex is a US-based company that offers payroll, human resource, and benefits outsourcing services. Paychex is headquartered in Rochester, New York, United States, and has offices nationwide. They are considered the largest provider of payroll services in the nation.

The company was founded in 1971 by Tom Golisano, who started the company with only $3,000. They serve over 590,000 different companies in all 50 states in America and over half a million employees.

They offer self-employed individuals, small business owners, and companies both large and small to outsource their payroll processing needs. They do this by taking care of all tax administration, payment processing, and other related tasks for their clients, leaving these businesses free to concentrate on their core business activities.

Benefits of Paychex eServices Login Account

You can get many benefits by logging in to Paychex eServices Portal https://eservices.paychex.com/secure/. Some of the significant benefits include:

- You can perform tax and deduction information changes on your portal.

- This includes making changes to withholding allowances, marital status, direct deposit, and more.

- You can also enroll in new benefit plans or update existing ones.

- You can view paystubs and print them for future reference.

- You can also change your personal information, such as emergency contact information and more on the account.

- You can add and view absences such as vacation, sick leave, and personal leave on your portal.

You may also check:

- Goodyear Self Service Portal

- Paycom Employees Login

- FedEx Employee Login

- Disney Hub Login

- Smart Square Mercy Login

- Kronos NYP Login

- HyVee Kronos Login

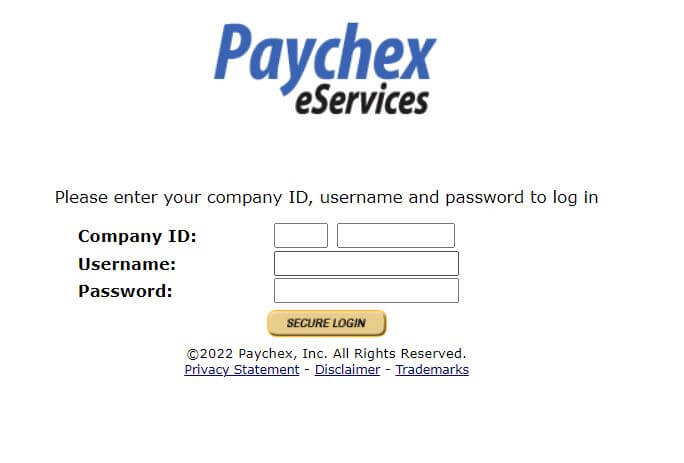

Paychex eServices Secure Login Requirements

- Paychex eServices Login web address

- Eservices.paychex.com/secure/ valid Company ID, Username, and Password

- Internet browser that is compatible with the Paychex eServices Employee Self-Service official website

- Laptop or PC or Smartphone or Tablet with Reliable internet access

How to Login into Paychex eServices Employee Self-Service Portal?

Following are the steps to Login into Paychex eServices Account:

- Visit the Paychex eServices Employee Portal official website at https://eservices.paychex.com/.

- It will take you to the Paychex eServices Login page.

- Here, you need to enter your Company ID, Username, and Password.

- After entering login credentials, click the “Secure Login” button to get into your eServices Paychex account.

How to Reset Paychex eServices Login Password?

Have you forgotten your password? If yes, then contact the Paychex eservices helpdesk. They will help you to retrieve your account login password.

Paychex eServices Helpdesk Contact Information

If you are facing issues accessing your Paychex eServices Login account, please contact Paychex eServices customer service.

- Phone Number: 833-299-0168

- Paychex Payroll Services Company official website: www.paychex.com

- Paychex eServices Login Official Website: https://eservices.paychex.com/

Paychex Social Media Handles

Final Words

This is all about the Paychex eServices login at https://eservices.paychex.com/secure/. We have shared everything related to the eServices Paychex Secure Portal, such as Paychex eServices Employee Login benefits, Eservices.paychex.com Secure Login steps, Paychex eServices help center contact details and more. We hope you found this article helpful. If you still have any queries, let us know through the comment.